Beyond Digital Art: How Could NFTs Transform Gaming, Music, Fashion, Collectables, and More?

NFTs have taken the world by storm. Verified Market Research (VMR) reported that in 2021 the NFT market was valued in excess of $11…

NFTs have taken the world by storm. Verified Market Research (VMR) reported that in 2021 the NFT market was valued in excess of $11 billion, and by 2030, they projected it would exceed $230 billion. From gaming and music to fashion and sports, NFTs offer the ability to track an asset in both digital and physical form throughout its lifecycle. This includes everything from manufacturing through to the supply chain, payment, and ownership. In this article, we’re going to explore how companies like Nike, Vacheron Constantin, and the NBA have used NFTs in recent years, and how this nascent technology might impact a variety of other global industries in the years and decades to come.

NFTs in Art

NFTs experienced somewhat instant success in the world of art for its ability to combat fraud, represent scarcity in a transparent and auditable way, and provide automatic royalties to the artist upon every sale of their artwork.

The use of blockchain technology enables each piece of art to be meticulously recorded in the public domain, making it very difficult for fraudsters to fabricate ownership histories or pass off counterfeit pieces as genuine. Scarcity becomes immediately transparent, providing a public record of the number of versions or editions ever created. Also feeding into those public records is transaction history, making it incredibly simple to track the movement of a given piece between owners.

NFTs operate on the blockchain using smart contracts, setup by the original creator. Forever linked to the piece of art, smart contracts not only track an asset but help to facilitate the payment and transfer of ownership. It also enables the creator to code in an automatic royalty payment based upon every future sale of their artwork. Importantly, this enables artists to continue receiving financial recognition if their artwork becomes increasingly valuable over the years. Royalty payments will even continue to be paid out after the death of the artist, enabling the beneficiaries of their estate to continue receiving royalty payments.

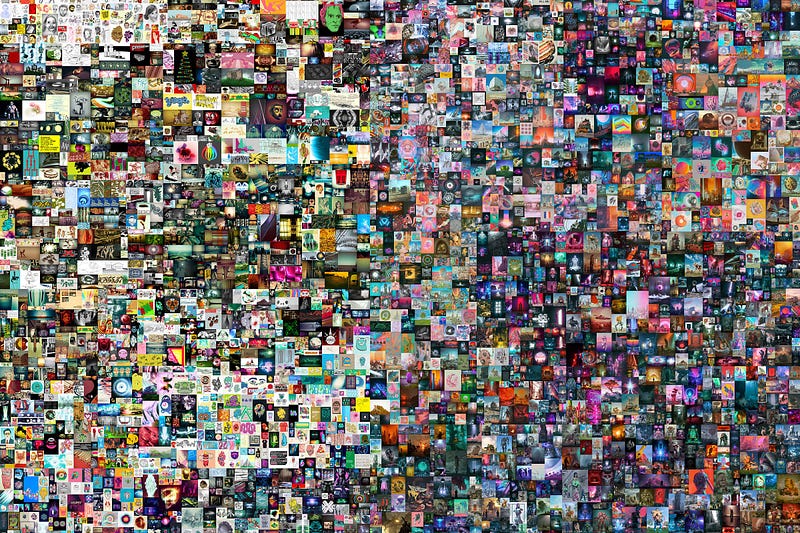

One of the most prominent success stories in the NFT art world is an artist who goes by the name of Beeple. His one-off digital artwork ‘Everydays: The First 5000 Days’ features a collage of 5,000 digital images single-handedly created by the artist, and was sold at Christie’s in 2021 for more than $69 million USD. Another prominent and interesting application of NFTs in art was a collection released in July 2021 by UK artist Damien Hirst, who dominated the art scene in the 1990’s.

Hirst released a collection of 10,000 NFTs called The Currency, with each NFT corresponding to one of 10,000 unique physical artworks, each stored in a secure vault in the UK. After a period of one year, the buyers of these 10,000 NFTs had to choose whether they would like to keep the digital artwork or the physical artwork. The digital artwork would forever live on the blockchain, whilst the physical artwork would be burned, and vice versa depending on the choice made by the owner. The approach is quite extraordinary, as it challenged the value of digital art versus physical art. According to artnet, 5,149 buyers (51.5%) chose to trade in their NFTs for the physical works. That left 4,851 holders of NFTs, and thus 4,851 physical works were destroyed.

Damien Hirst at Newport Street Gallery for the grande finale of The Currency. Photo: Naomi Rea.

NFTs in Gaming

In recent years, games like Axie Infinity and Decentraland have risen to fame for allowing players to buy and sell in-game items and assets as NFTs. This has given birth to an entirely new economy within the gaming world, where players can earn an income whilst playing games and trading in-game assets. In 2021, a plot of digital land on Axie Infinity sold for a staggering $2.3 million.

Nike is taking a significant step towards merging gaming and cryptocurrency as its NFT platform, .Swoosh, is set to integrate with EA Sports games. This partnership will allow Nike’s virtual footwear and apparel, represented as NFTs, to potentially appear in popular EA Sports titles like FIFA, Madden NFL, and NBA Live. While the specific games haven’t been disclosed yet, it’s expected that players will be able to purchase and customise Nike NFTs as wearable add-ons for their in-game avatars. Nike introduced its .Swoosh NFT platform in November 2022, and it recently released its first NFT collection, “Our Force 1,” which has gained significant traction in the NFT market. This move follows Nike’s earlier entry into the metaverse through acquisitions and the launch of Nikeland, although .Swoosh, RTFKT, and Nikeland are distinct projects for the company.

The big question for those in the crypto and gaming space is how established gaming franchises could possibly incorporate NFTs into their games. Some games, however, already present a natural synergy with NFTs. One such example is the Pokemon franchise, which rose to fame for its trading card collections and Nintendo games. NFTs have the ability to transcend both the physical and digital world, able to represent both physical trading cards and in-game assets, not only creating a brand new secondary market for in-game assets, but enhancing traceability and fraud prevention in trading cards. Interestingly, the company behind the popular franchise recently posted a job listing for a “Corporate Development Principal” role, which includes the requirement for “deep knowledge” of Web3, NFTs, and the metaverse.

NFTs in Music

The rise of music streaming services like Spotify and Apple Music has drastically changed the way people consume music. While it has made music more accessible to listeners, it has also had a significant impact on artists and their earnings. Streaming services typically pay artists a fraction of a penny per stream, meaning even the most popular artists may struggle to earn a living from streaming royalties alone. This has led to concerns about the fairness and sustainability of the streaming model, and has motivated some artists to explore alternative ways of monetising their work.

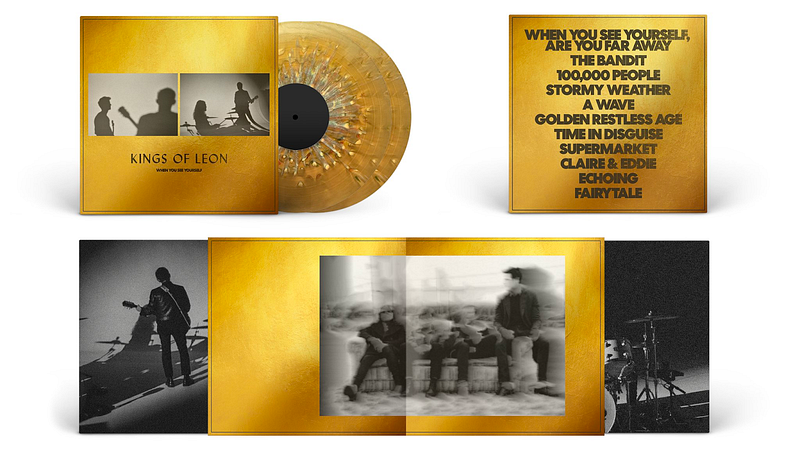

In March 2021, Grammy Award winners Kings of Leon made history releasing their eighth studio album, “When You See Yourself,” as an NFT. The band offered three different types of tokens for sale, each with exclusive perks for fans. The first type, called the “Golden Ticket” NFT, provided lifetime VIP access to any Kings of Leon concert anywhere in the world. The second type, the “Live Show” NFT, gave fans front-row seats to a future Kings of Leon concert of their choice, complete with a personal driver and hotel accommodations. The third type, the “Audiovisual Art” NFT, featured a digital album package, a limited-edition vinyl set, and a digital download of the album. The album NFTs were sold on the YellowHeart platform, and reportedly generated over $2 million in sales.

Earlier that same year, Grammy-nominated DJ and producer 3LAU made history as one of the first solo artists to release his album “Ultraviolet” as a series of NFTs, providing buyers with exclusive perks and benefits, such as access to unreleased tracks, limited-edition remixes, and special behind-the-scenes content. Additionally, the NFTs granted holders VIP privileges such as meet-and-greets with 3LAU, access to exclusive events, and future airdrops of his music.

These moments are marking a significant moment in time for the music industry, as it demonstrates the potential for artists to monetise their work in new and innovative ways, whilst enhancing their ability to connect with fans.

NFTs in Fashion

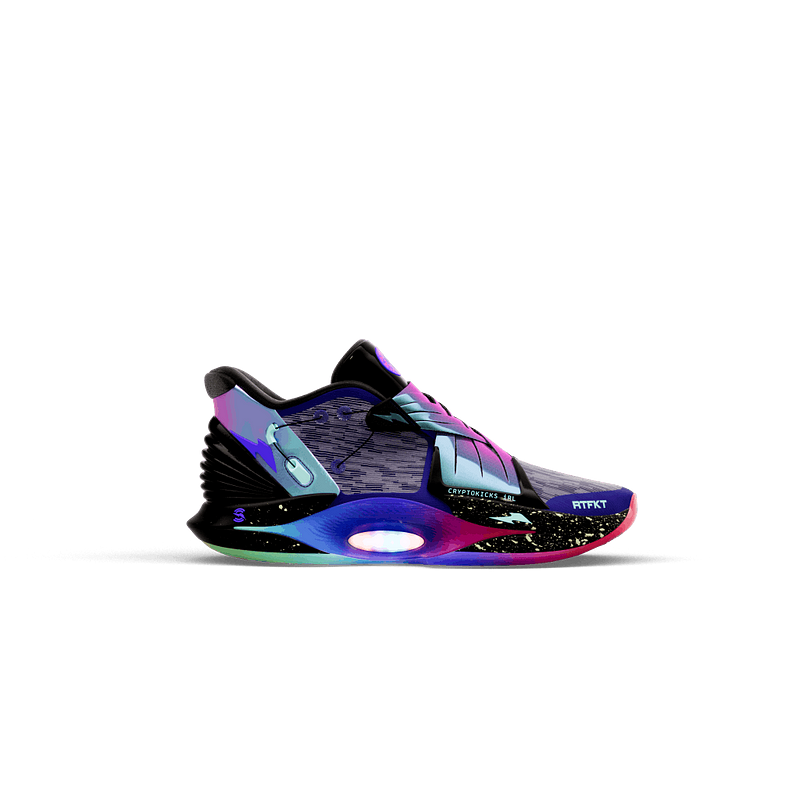

Digital fashion design house, RTFKT Studios partnered with Nike in May 2021 to launch the “Cryptokicks IRL” sneaker collection. The collection featured four virtual sneaker designs in NFT format that could be redeemed for physical sneakers made by Nike. Each sneaker has its own unique digital asset stored on the blockchain, providing a level of authenticity and exclusivity for the purchaser.

In addition to creating new revenue streams and engaging with customers in new ways, NFTs can also help fashion brands tackle the problem of counterfeiting. By creating a unique NFT for each physical product, brands can verify its authenticity and ownership history on the blockchain, making it difficult for counterfeiters to produce fake versions. This can provide greater confidence for buyers and collectors alike, as well as help brands protect their reputation and value. Additionally, NFTs can provide valuable data on the ownership and distribution of physical products, allowing brands to better understand their supply chain and customer preferences.

The size of the fashion counterfeit market is difficult to estimate precisely, but it is a significant global issue. According to the Global Brand Counterfeiting Report 2018, the total global value of counterfeit goods reached $1.2 trillion in 2017, with fashion-related products accounting for a significant portion of that value.

Vacheron Constantin is using blockchain technology to provide authentication and traceability for its luxury watches. The Swiss watchmaker has partnered with blockchain technology firm Arianee to develop a digital certification system that uses blockchain to create a unique and secure record of ownership and provenance for each watch. With this system, Vacheron Constantin can create a tamper-proof record of each watch’s manufacturing history, ownership, and service history, which can be accessed and verified using a secure digital wallet. This allows buyers and collectors to be confident that they are purchasing a genuine Vacheron Constantin timepiece, and it also allows Vacheron Constantin to provide after-sales services and support for its customers. By using blockchain technology, Vacheron Constantin can ensure that the digital certification is immutable and cannot be altered or falsified. This helps to combat counterfeiting and creates a more transparent and secure system for tracking the lifecycle of luxury goods.

NFTs in Collectables

Counterfeiting is a significant problem that has plagued the trading card industry for decades. The scale of the problem is difficult to quantify, but it is estimated that counterfeiting costs the industry millions of dollars each year.

Counterfeiters often create fake cards that are difficult to distinguish from genuine cards, especially to untrained eyes. Counterfeiting is particularly prevalent in the sports trading card market, where high-value cards are a prime target for counterfeiters. These fake cards are often sold online or through other channels, deceiving unsuspecting collectors into buying them at inflated prices. Counterfeiters also create fake autographed cards, which can be difficult to detect unless authenticated by a reputable third-party service.

Over the years, trading card companies have implemented various security measures, such as holograms, serial numbers, and other technologies to verify the authenticity of their cards. Additionally, third-party authentication services have emerged to provide collectors with a reliable way to verify the authenticity of their cards. Blockchain technology is one of the latest measures that is growing in popularity.

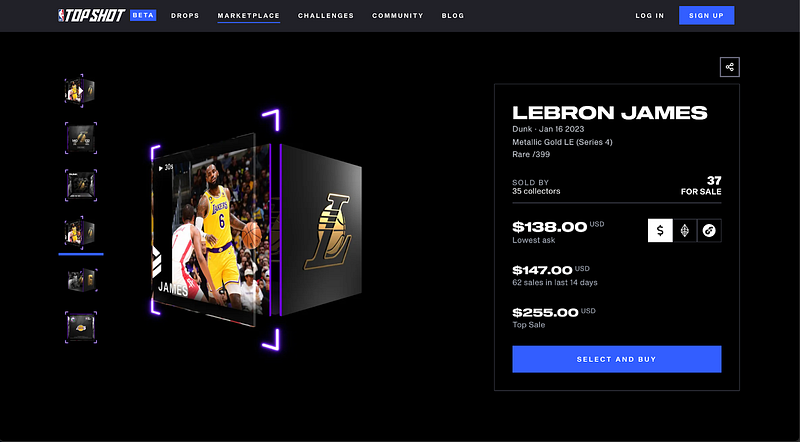

The NBA’s partnership with Dapper Labs has led to the creation of NBA Top Shot, a blockchain-based platform for buying, selling, and trading officially licensed NBA NFTs in the form of digital trading cards. These digital collectibles use blockchain technology to provide proof of authenticity and ownership, as well as scarcity, as each card is issued in a limited edition. This allows for transparent tracking of ownership history and transaction records, which can help prevent fraud and counterfeiting. NBA Top Shot has gained significant popularity since its launch in 2020, with some NFT trading cards selling for hundreds of thousands of dollars.

Topps recently turned its physical trading cards into NFTs. In the Topps MLB Collect app, users can collect and trade digital versions of Topps baseball cards, represented as NFTs. These digital cards can then be used in various games, such as “BUNT,” where users can build their own virtual baseball team using the digital cards they collect, and compete against other players’ collections. The app also includes other interactive experiences, such as trivia games and virtual autograph signings with baseball players.

Electroneum’s entry into the NFT space

The potential for NFTs reaches far beyond its beginnings in the digital art world. It even reaches far beyond the use cases mentioned in this article. Like the barcode, which took several decades to become mainstream, it is possible that NFTs will evolve over a long period of time, adapting to the needs of businesses around the world. That is why the Electroneum blockchain is going through a massive upgrade to Aurelius, its sixth and best version yet.

For the first time ever, developers will be able to build and deploy smart contracts on the Electroneum blockchain. More importantly, those applications will be interoperable with other EVM-compatible blockchains, such as Ethereum, Binance Smart Chain, Polygon, Fantom, Avalanche, and other prominent blockchains. This, in turn, will allow developers to build NFT-based solutions on the Electroneum blockchain, maintaining compatibility with other EVM-compatible blockchain applications, but whilst benefiting from the advantages of the Electroneum blockchain. These include potentially the lowest EVM interaction fees in the industry and five second transaction speeds with instant finality.

If you work for a business that would benefit from the introduction of NFTs, be sure to reach out to the Electroneum team and discuss your requirements: opportunities@electroneum.com